Category: Trading

Trading is nothing more than: buying and selling things (goods, currencies, percentage shares of companies, gold, silver, timber, etc) with the expectation to make a profit.

A supermarket is trading when it buys products from their suppliers and sells to the public. You are also trading when you buy and sell your car, or your house, although you might not be doing these transactions with the intention to make profit.

One of the big differences between “financial trading” versus “trading of you personal stuff”, is that financial trading can be done very easily online, using brokers and financial institutions which allow you to buy and sell assets without you having to leave your chair.

You might live in a small apartment, even without space to store a bike, but you can buy a ton of timber today and sell it next month, without never seen the color of the wood. You would have companies storing the timber, transporting, etc and at your end, you don’t need to worry anything about the logistics, warehousing, etc. You just buy it with a click from your preferred broker, and sell it with other click, as long as you have the money in you account.

What can be traded?

Financial trading is easy because usually involves the buying and selling of financial instruments, which realistic are not the goods in question, but papers which guarantee the value and your ownership of the the real thing.

Going back to our example above, to buy a ton of timber, you would be actually buying just a paper that says you own the timber, or even better, a paper that says that you own a percentage of a firm that owns that timber, and ensure it is well stored, transported, etc.

These “financial instruments” (or papers) can be representing percentage shares of companies, currencies, metals, commodities (like that timber), bonds and much more.

And the principle of trading is always the same: you buy a financial instrument, and sell it afterwards for a profit. Unless there is a restriction on what you are trading, you can sell one minute, or ten years after you’ve bought.

Who does the trading?

Millions of individuals, companies, institutions and governments spread over the globe are 24 hrs all week trying to profit from buying and selling financial instruments.

As so many people is buying and selling, prices are constantly moving up or down. Usually the amount of “traders” buying and selling something can also affect its price, as supply and demand effects take place.

A market that moves a lot is known as a volatile market. These markets bring more opportunities for profit, but also mean increased risk.

Where trading happens?

You can be trading from your sofa, or even from the beach using a smartphone, but transactions and financial instruments need to be validated by serious institutions which are not distracted with the swing of hammocks. From your sofa, or from you beach hammock you usually send orders to brokers, to buy or sell a financial instrument.

Brokers will do the actual trading, usually in exchanges, which are highly organised marketplaces where a particular instrument is bought and sold (like the New York Stock Exchange or the London Stock Exchange)

Also, they can be traded over-the-counter, when two parties agree to trade instruments with each other. But in these cases, usually there is an independent institution that validates the transaction, assuring both parties about the validity of the papers (and the transaction).

-

-

Bitcoin Mining – How to earn Bitcoins now!

Bitcoin mining is one of the hottest topic around crypto currencies. As Bitcoins rise astronomically in popularity (and valuation), mining becomes more attractive. On the other hand, due to the… Continue reading "Bitcoin Mining – How to earn Bitcoins now!" -

eToro – Copying profitable traders

eToro is a revolutionary trading platform, which combines social features with money making strategies. In eToro you can invest in stocks (google, tesla, apple, etc), currencies (forex), crypto currencies (bitcoins, ethereum, etc),… Continue reading "eToro – Copying profitable traders" -

What is Forex

The term FOREX aka FX or foreign exchange simply means trading currency in the foreign exchange market, buying a currency with other. The concept is similar to situations as when… Continue reading "What is Forex" -

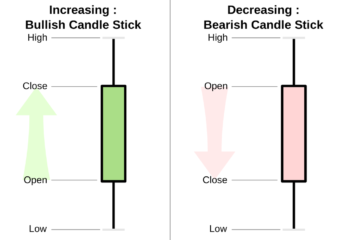

What are Japanese Candlesticks charts?

Traders use many tools to help them predict the direction of the market. Japanese candlestick is one such tool that most traders rely on to better understand the price direction.… Continue reading "What are Japanese Candlesticks charts?" -

Dare to be a day trader?

You have seen them in the movies, screaming at their phones asking to buy a few thousand or to sell a few millions worth of stocks. Meet the Day trade,… Continue reading "Dare to be a day trader?" -

What type of investor are you?

You may not wear an Armani suit or drive a Bentley. You may not yet know the difference between an EBITA and EPS, or may not have any clue at… Continue reading "What type of investor are you?" -

Is this a good stock at a cheap price, or a cheap stock at a good price

New investors may not know the difference between the two, so let me give you an analogy. You visit a watch store and you have your eyes on two specific… Continue reading "Is this a good stock at a cheap price, or a cheap stock at a good price" -

Easy investment strategies for a new investor

Deciding to invest in the stock market can be an exciting proposition and if you do it right, there are plenty of rewards to reap. I hope this brief article… Continue reading "Easy investment strategies for a new investor" -

What is leverage?

Leverage means the use of debt to fund an investment – a technique that has the potential to enhance returns, but also to amplify losses. Imagine that several investors get… Continue reading "What is leverage?"